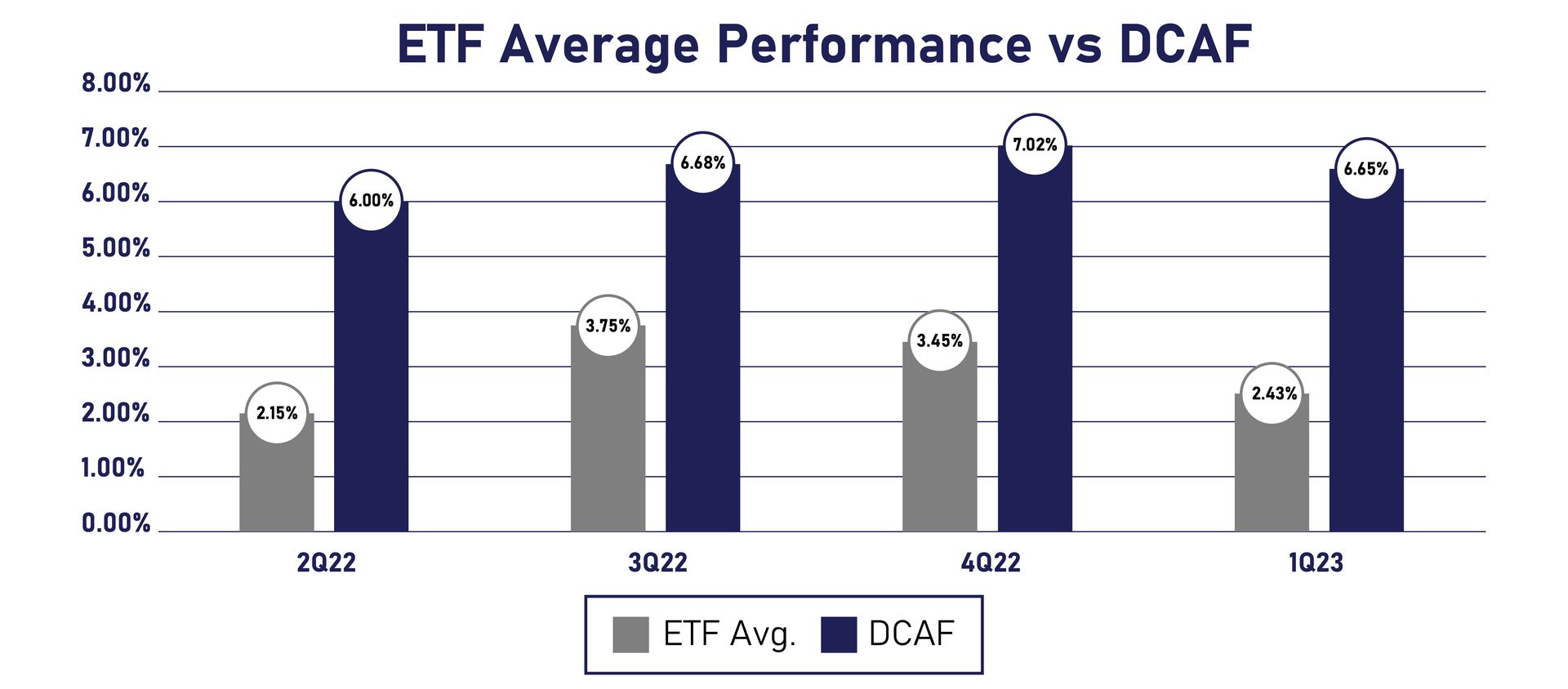

To measure our success, we take the three largest ETFs and average their returns. Our goal is to be 1.5-2 times greater than that benchmark. If we succeed that benchmark by 3 consecutive quarters we will reevaluate our unit price, and that is how investors can take advantage of the equity ownership of the fund.

Dual City Advantage Fund

Wealth Protection | Income generation

Historical performance compared to public etf

fund benefits

The Dual City Advantage Fund is a blind pool, private equity, evergreen fund.

- Cash flow

- Appreciation

- Diversification

- No lock-up period

- 90/10 Investor split

- 90/10

The DCAF Advantage

- Acquire assets through all stages of the CRE market cycle.

- Utilizing our tax-deferred exchange to transact in more situations than the competition.

- Leveraging our associate brokerage, financing, and insurance companies to efficiently transact.

The Macro Strategy

- Compounding results by using the Evergreen strategy.

- Diversity across geographic markets and asset classes.

- Favorable investor splits (90%) with capital preservation at the forefront.

- Long-term goal of converting to a public offering.

dual City's core values

- Fidelity

- Integrity

- Protection

- Procedure

- Performance

- Trustworthy and consistent real estate investment options

KEEP IN TOUCH

Sign up and stay up-to-date about what's happening.